Montana 2026 Health Insurance Premiums: What to Do Before Prices Jump | RKA

Montana health insurance premiums are projected to rise in 2026, with insurers citing higher medical costs and subsidy uncertainty. Families could see significant changes in out-of-pocket costs. Here’s what to know—and how private PPO options may help you save before rates jump.

Montana • Premium Watch

Montana 2026 Health Insurance Premiums: What to Do Before Prices Jump

Fast take: Montana insurers have filed for notable premium increases for 2026. Rising medical costs, specialty drugs, and subsidy uncertainty could push net prices higher. Here’s how to prepare and compare now.

What’s driving the increase?

- Medical inflation: Higher provider costs and hospital charges are impacting trend.

- Specialty drugs: Expensive medications like GLP-1 therapies are raising premiums.

- Policy shifts: Enhanced ACA subsidies may expire, impacting net household costs.

Moves to consider now

1) Review your plan type

If you travel across state lines, a nationwide PPO may provide broader access and lower surprise costs than an HMO.

2) Time your enrollment

Open Enrollment later this year sets your 2026 price. We’ll help compare ACA and private PPO options side by side.

3) Explore private PPO eligibility

Private, medically underwritten PPOs can offer lower premiums for healthy households. We pre-screen underwriting and confirm provider networks.

How RKA helps Montana families

- Plan comparisons: ACA vs. PPO side-by-side analysis.

- Network checks: Verify your doctors and hospitals are covered.

- Quick enrollment: Avoid coverage gaps and set 2026 pricing now.

Quick FAQs

Will 2026 premiums apply to my plan immediately?

Are PPOs available in Montana?

Can RKA confirm if my doctors are in-network?

For education only; eligibility and benefits vary by carrier and state. Always review official plan documents.

Group Employer Open Enrollment: Rising Costs, Smarter Options for Employers & Employees | RKA

Employer plan premiums are rising this fall. During open enrollment, compare group coverage against marketplace and private PPO options—splitting family members can cut costs. We’ll verify doctors, prescriptions, and total annual cost before you commit.

Employer & Group Plans • Open Enrollment

Group Open Enrollment: Rising Costs, Smarter Options for Employers & Employees

Fast take: With medical inflation and rising utilization, many employer plans are increasing premiums and tweaking benefits this fall. Use open enrollment to compare — keeping the employee on the group plan, but placing a spouse/kids elsewhere can cut costs without giving up access. We’ll verify networks, prescriptions, and total annual cost before you choose.

Why costs are climbing

- Medical inflation: Hospital, physician, and facility prices continue to outpace wage growth.

- Rx trend: Specialty drugs (including GLP-1 therapies) are widening plan spend.

- Higher utilization: Delayed care is catching up, pushing claims higher.

- Plan design shifts: Employers may raise deductibles/copays or adjust contributions to manage increases.

What to compare during open enrollment (October–December)

Employer plan checklist

- Employee vs. family premium contributions

- Deductible, copays/coinsurance, out-of-pocket max

- HSA/HRA funding and employer credits

- Network type (HMO/EPO vs PPO) and doctor/hospital fit

- Rx formulary & prior authorization rules

Compare against alternatives

- Marketplace: Check income-based subsidies; silver cost-sharing reductions if eligible

- Private PPO (underwritten): Often lower for healthy applicants; nationwide PPO access

- Spouse’s employer plan: Sometimes better dependent rates

- COBRA: Short-term bridge if switching mid-year

When keeping the group plan and splitting the family wins

Dependent premiums on employer plans can be steep. A common savings move: keep the employee on the group plan (to capture employer contribution and HSA access) and place a spouse or kids on marketplace or a private PPO if the numbers — and networks — work better.

Decision pathway

- Send us your details: household members, providers, prescriptions, and employer plan options.

- We verify networks & Rx: employer plan vs marketplace vs private PPO.

- We model total annual cost: premium + likely usage + tax/HSA effects.

- You pick and enroll: we execute cleanly and avoid gaps.

Tips for employers (quick wins)

- Offer an HSA-compatible plan with modest employer HSA seed to offset deductibles.

- Communicate a clear “how to compare plans” guide with provider verification steps.

- Consider ICHRA/QSEHRA strategies if group renewal is unsustainable.

Quick FAQs

Is the employer plan always best?

Can you verify our doctors and hospitals first?

Can we switch mid-year?

Educational use only; benefits and eligibility vary by employer, carrier, and state. Always review official plan documents.

Texas 2026 Health Insurance Premiums: What to Do Before Prices Jump

Texas marketplace insurers are signaling higher 2026 premiums. Here’s how to lower costs—plan timing, private PPO options, and Rx strategy

Texas • Premium Watch

Texas 2026 Health Insurance Premiums: What to Do Before Prices Jump

Fast take: Texas marketplace insurers have filed for notable premium increases for 2026. Costs are being driven by higher medical prices, utilization, and pricey drugs. If enhanced federal subsidies expire after 2025, some households could see larger net costs. Here’s how to prepare—and options to compare now.

What’s behind the increase?

- Medical inflation & utilization: Providers and hospitals are charging more, and people are using more care.

- High-cost drugs: GLP-1 medications and other specialty drugs are materially affecting trend.

- Policy uncertainty: If enhanced ACA subsidies end after 2025, net premiums may rise for many families.

Moves to consider now

1) Audit your plan type

Check whether your current plan fits your usage. If you travel or work across state lines, a nationwide PPO may offer better access and predictable costs on the road.

2) Time your enrollment

Open Enrollment later this year sets your 2026 price. We can compare multiple options side-by-side—including marketplace plans and other eligible choices—so you don’t overpay.

3) Consider private PPO with medical underwriting

For healthy individuals and families, private, medically underwritten PPO options can offer lower premiums than unsubsidized ACA plans, broad nationwide PPO access, and predictable day-to-day costs. Eligibility depends on underwriting; we’ll pre-screen quickly and confirm network access so you know if it’s a fit.

4) Rx strategy

Know your drug tiering and prior auth rules. When appropriate, ask about generics, patient assistance, or discount programs to lower out-of-pocket costs.

How RKA helps Texans

- Plan matching: We compare options from major carriers and traveler-friendly PPOs.

- Cost projection: We estimate your annual cost with premiums + likely usage so you choose confidently.

- Fast enrollment: We can place coverage quickly and help you avoid gaps.

Quick FAQs

Will 2026 marketplace prices impact my plan right away?

Are there alternatives if I’m healthy and want lower premiums?

Can RKA verify if my doctors are in-network?

For education only; benefits and eligibility vary by carrier and state. Always review official plan documents.

Remembering 9/11

On September 11th, 2001, life seemed to stop. As a sophomore in South Jersey just hours from NYC, I watched in disbelief as the towers fell. My family’s service with the Longport NJ Volunteer Fire Dept at Ground Zero showed me that unity and service are responsibilities we all share. We will never forget.

Reflection • September 11th

Remembering 9/11

“We will never forget.”

September 11th, 2001 is a day forever etched in my memory. I was a sophomore in high school in South Jersey—just two and a half hours from New York City. That morning, life seemed to stop. Everyone was glued to the television, watching in disbelief as the towers crumbled live on the screen. The silence in our community was deafening, broken only by the sounds of worry, grief, and prayers. It was something no human has ever witnessed. No one knew what to do, what to say.

For my family, service to others has always been a foundation. Members of the Longport, NJ Volunteer Fire Department went to Ground Zero in the days that followed, helping with rescue and cleanup efforts. Their courage—and the unity I saw across our nation in those days—left a lasting impression on me. It reinforced the belief that no matter the challenge, we are stronger when we come together in service of one another.

Today, as we remember those we lost and honor the bravery of first responders and everyday heroes, I am reminded that unity and service are not just values—they are responsibilities. On this day, we pause not only to remember but to recommit ourselves to looking out for one another.

— Robert Adams

RKA Insurance Advisors

Florida 2026 Health Insurance Premiums: What to Do Before Prices Jump

Florida health insurance premiums are projected to rise in 2026. Learn what’s driving the increases, how subsidies and PPO options compare, and the steps you can take now to protect your budget.

Florida • Premium Watch

Florida 2026 Health Insurance Premiums: What to Do Before Prices Jump

Fast take: Florida insurers are signaling notable rate increases for 2026. Rising medical costs, expensive prescriptions, and potential loss of federal subsidies mean many households could face higher bills. Here’s how to prepare now.

Why are rates climbing?

- Medical inflation: Hospitals and providers are charging more each year.

- Prescription costs: High-cost drugs like GLP-1s are putting pressure on premiums.

- Policy shifts: Enhanced ACA subsidies could expire after 2025, raising net costs for many Floridians.

Smart moves for Florida households

1) Audit your plan type

Does your plan still fit? If you travel or want wider access, a PPO may reduce out-of-network surprises and give better provider choice.

2) Plan enrollment timing

Open Enrollment later this year locks in your 2026 premiums. We’ll run side-by-side comparisons of ACA marketplace plans and private options so you don’t overpay.

3) Explore private PPOs

For healthy applicants, private, medically underwritten PPOs may deliver lower premiums, broad provider networks, and more predictable costs. RKA will pre-screen and verify eligibility quickly.

4) Prescription strategy

Check formulary tiers, ask about generics, and use discount programs or assistance where available to lower Rx spending.

How RKA supports Floridians

- Custom plan matching: We compare major carriers and PPO alternatives.

- Cost projection: Annual cost estimates include both premiums and expected usage.

- Fast enrollment: We help you secure coverage quickly without gaps.

Quick FAQs

When will Florida’s 2026 rates affect me?

Are private PPOs available in Florida?

Can RKA confirm my doctors are covered?

For education only; benefits and eligibility vary by carrier and state. Always review official plan documents.

COBRA vs Marketplace vs Private PPO: What to Do Right After You Lose Employer Coverage

Quick guide to COBRA vs Marketplace vs Private PPO—costs, networks, and when each wins. We’ll verify your doctors and show clear prices.

COBRA vs Marketplace vs Private PPO: What to Do Right After You Lose Employer Coverage

Laid off, new job, or between jobs? Here’s the fast, practical guide—costs, networks, deadlines, and how to decide in minutes. We’ll verify your doctors and show clear costs.

- Same network/benefits you already know.

- Usually most expensive (you pay full premium + 2%).

- Time-limited (18 months); retroactive if elected on time.

- Good when in treatment and changing plans is risky.

- May be cheapest if your income qualifies for credits.

- Many plans are HMO/EPO; referrals are common.

- Mid-year move allowed due to loss of coverage.

- Credits reconcile at tax time—under-reporting income can create payback.

- Nationwide PPO when eligible; keep specialists/hospitals.

- Typically no referrals; fewer hoops.

- Advance premium tax credits do not apply to Private PPOs.

- Pricing = age, ZIP, benefits, and network.

- Great when you travel or want doctor choice.

What tends to cost more—and why

Why COBRA is often pricey

- You pay the entire employer premium + 2% admin fee.

- Large-group plan designs can carry higher OOP maxes.

- No income-based help.

How non-Marketplace Private PPO prices

- Based on age, ZIP, network size, and benefits.

- Good fits: provider choice, travel, specialist access, fewer referrals.

- We verify your doctors before you switch.

How to decide in minutes

Pick COBRA if…

- You’re mid-treatment and can’t risk network changes.

- You can stomach short-term higher premiums.

- You need exactly the same plan and doctors right now.

Pick Private PPO if…

- You want nationwide PPO and typically no referrals.

- You travel, use specialists, or dislike gatekeepers.

- Credits don’t help you—or you prefer not to use them.

Want the best post-employer fit in your ZIP?

We’ll verify your doctors and meds, compare COBRA vs Marketplace vs Private PPO, and show clear costs. No pressure—just answers.

FAQ

How long do I have to elect COBRA?

Can I switch from COBRA to other coverage later?

Do Private PPOs use ACA tax credits?

How do I know if my doctors are covered?

How do we start?

This overview is educational, not tax or legal advice. Availability varies by state and carrier. Eligibility and enrollment subject to plan terms.

New to Texas? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Texas health insurance, made simple: Marketplace credits vs Private PPO, how networks differ, start dates, and what to verify first. We’ll check your doctors and show clear costs.

New to Texas? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Just moved to TX? Here’s how coverage works, what proof you’ll need, and how to keep your doctors. We’ll verify providers and show clear costs—no pressure.

- Can be cheapest if your income qualifies for credits.

- Many plans are HMO/EPO; referrals are common.

- Options vary by county/ZIP.

- Move = special enrollment (time-limited). Credits reconcile at tax time.

- Nationwide PPO access when eligible; keep key doctors/hospitals.

- Typically no referrals; fewer hoops for specialists.

- Pricing isn’t tied to ACA income credits.

- Good for travel, provider choice, and specialist access.

What to do first (takes 5 minutes)

1) Gather quick proof

- New TX address (lease, closing docs, utility, USPS change).

- Prior coverage details if switching.

2) List providers & meds

- Doctors, specialists, hospitals you want to keep.

- Current prescriptions (name + dosage).

3) Decide priorities

- Lowest premium vs. broad network.

- Referrals OK or prefer no referrals?

- Travel out of state?

What drives cost in Texas

Marketplace

- Income & household size (for tax credits).

- Plan level & network (HMO/EPO common).

- County—options can change across county lines.

Private PPO

- Age, ZIP, benefit level, and network size.

- No ACA credits; premiums are straightforward.

- Great when keeping providers is the priority.

Simple decision guide

Choose Marketplace if…

- Your income qualifies for strong credits.

- You’re OK with HMO/EPO rules & referrals.

- Lowest premium is the top priority.

Choose Private PPO if…

- You want broad, often nationwide PPO access.

- You prefer no referrals to see specialists.

- Keeping specific doctors/hospitals matters most.

New to Texas? Let’s lock the best fit in your ZIP.

We’ll verify your doctors and meds, compare Marketplace vs Private PPO, and show clear costs. No pressure—just answers.

FAQ for recent Texas moves

Do I get a special enrollment window when I move to Texas?

What proof of my move do I need?

When will coverage start?

Can I keep my current doctors?

What if I’m coming from COBRA?

This overview is educational, not tax or legal advice. Availability and rules vary by carrier and county. Eligibility and enrollment subject to plan terms.

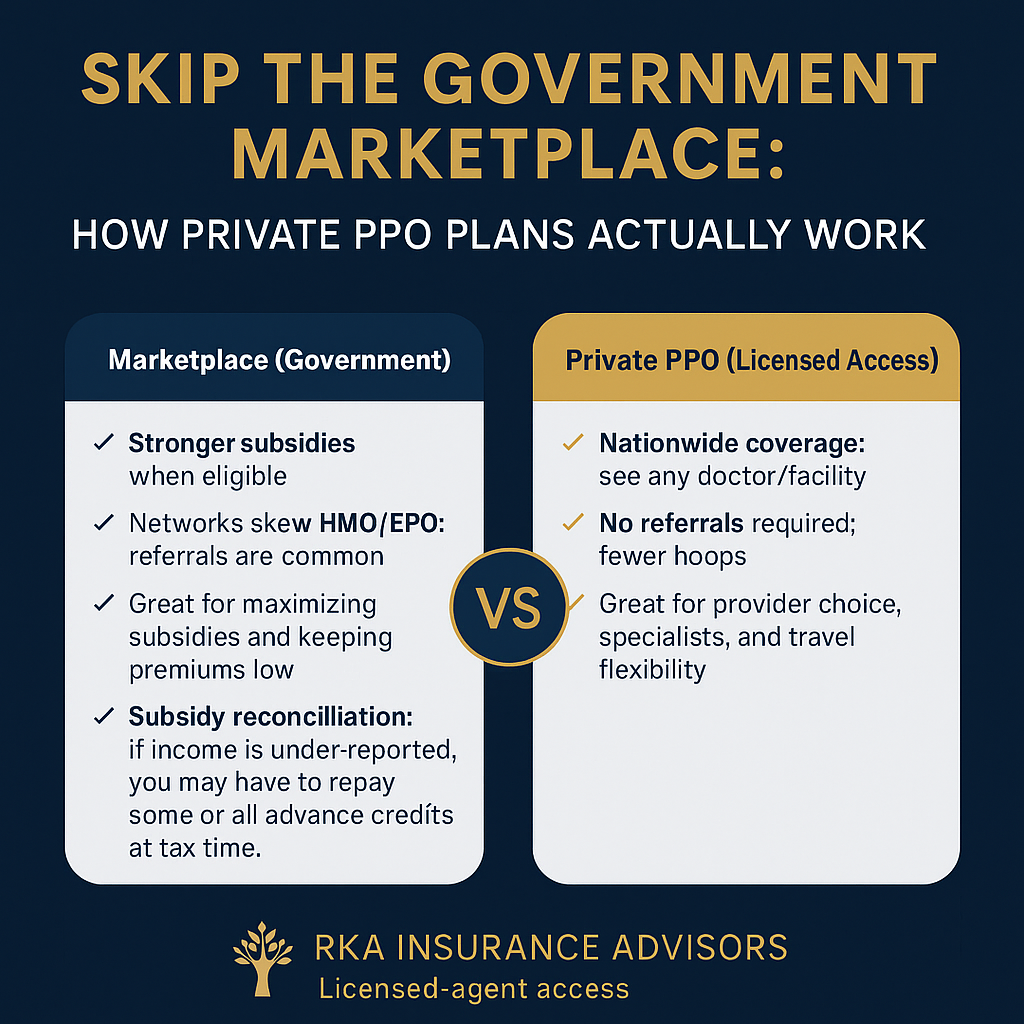

Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

Why some people skip the Marketplace

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

How Private PPO actually works

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

Do Private PPOs need referrals?

Will I owe taxes if I’m not using subsidies?

How do I know if my doctor is covered?

How do we start?

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.

New to Florida? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Fast guide for Floridians who just moved—how coverage works, proof to have ready, and how to keep your doctors. We compare Marketplace vs Private PPO and show clear costs.

New to Florida? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Just moved to FL? Here’s how coverage works, what proof you’ll need, and how to keep your doctors. We’ll verify providers and show clear costs—no pressure.

- Can be cheapest if your income qualifies for credits.

- Many plans are HMO/EPO; referrals are common.

- County-based options; networks vary by ZIP.

- Move = special enrollment (time-limited). Credits reconcile at tax time.

- Nationwide PPO access when eligible; keep key doctors/hospitals.

- Typically no referrals; fewer hoops for specialists.

- Pricing isn’t tied to ACA income credits.

- Good for travel, provider choice, and specialist access.

What to do first (takes 5 minutes)

1) Gather quick proof

- New FL address (lease, closing docs, utility, USPS change).

- Prior coverage details if switching.

2) List providers & meds

- Doctors, specialists, hospitals you want to keep.

- Current prescriptions (name + dosage).

3) Decide priorities

- Lowest premium vs. broad network.

- Referrals OK or prefer no referrals?

- Travel out of state?

What drives cost in Florida

Marketplace

- Income & household size (for tax credits).

- Plan level & network (HMO/EPO common).

- County—options can change across county lines.

Private PPO

- Age, ZIP, benefit level, and network size.

- No ACA credits; premiums are straightforward.

- Great when keeping providers is the priority.

Simple decision guide

Choose Marketplace if…

- Your income qualifies for strong credits.

- You’re OK with HMO/EPO rules & referrals.

- Lowest premium is the top priority.

Choose Private PPO if…

- You want broad, often nationwide PPO access.

- You prefer no referrals to see specialists.

- Keeping specific doctors/hospitals matters most.

New to Florida? Let’s lock the best fit in your ZIP.

We’ll verify your doctors and meds, compare Marketplace vs Private PPO, and show clear costs. No pressure—just answers.

FAQ for recent Florida moves

Do I get a special enrollment window when I move to Florida?

What proof of my move do I need?

When will coverage start?

Can I keep my current doctors?

What if I’m coming from COBRA?

This overview is educational, not tax or legal advice. Availability and rules vary by carrier and county. Eligibility and enrollment subject to plan terms.

Marketplace vs Private PPO: Costs, Networks, and When Each Wins

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs

Coverage Options • Open Enrollment

Marketplace vs. Private PPO: Costs, Networks, and When Each Wins

Fast take: Marketplace (government exchange) plans can be cheapest if your income qualifies for subsidies. Private PPOs usually win on doctor access, nationwide networks, and fewer hoops. At RKA Insurance Advisors, we compare both—then you decide.

Quick Definitions

- Marketplace (Government): Plans sold on Healthcare.gov or your state exchange. Prices drop with income-based subsidies. Networks are often HMO/EPO-heavy.

- Private PPO (licensed access): Off-exchange, available through licensed advisors. Broader PPO networks, out-of-network flexibility, and year-round enrollment.

👉 No guessing: We verify your doctors and prescriptions on both sides before you enroll.

Cost Snapshot

Marketplace

Price depends on income and household size. Silver-tier plans can unlock extra savings if you qualify.

Private PPO

Price is not income-based. You’re paying for broader networks and fewer restrictions.

Networks & Doctors (What Matters Most)

Marketplace networks can be narrow. Great if your providers are in-network; painful if they’re not. Private PPOs typically offer national or near-national PPO networks, plus out-of-network benefits.

We always check your providers first—not after you enroll.

When Marketplace Wins

- Your income qualifies for strong subsidies.

- You’re fine with a narrower network.

- You want the lowest possible premium and rarely use care.

When Private PPO Wins

- You want flexibility with doctors and facilities.

- You travel often and need PPO access nationwide.

- You’ve been frustrated with referrals and authorizations before.

The Simple Decision Tree

- Share your providers, prescriptions, and budget.

- We verify both Marketplace and PPO paths in your ZIP code.

- You pick the best fit. We enroll you quickly and compliantly.

Quick FAQs

Does Marketplace always cost less?

Can RKA check my doctors in both networks?

Is Private PPO available year-round?

Educational use only; eligibility and benefits vary by state and carrier. Always review official plan documents.

Trump’s “Big, Beautiful Bill” & Healthcare in 2025: Florida Private PPO vs ACA

Trump’s “Big, Beautiful Bill” could reshape health insurance in 2025. Learn how Florida families, self-employed professionals, and small business owners are weighing private PPO plans with $0 deductibles as alternatives to ACA subsidies and government-backed options.

Florida • Coverage Strategy

Trump’s “Big, Beautiful Bill” & Healthcare: Florida ACA vs. Private PPO in 2025–2026

Fast take: Policy changes tied to federal budget/reform efforts may mean tighter subsidies, new Medicaid limits, and rising employer/ACA costs. For Florida families and self-employed workers, the smartest play is to compare ACA plans vs. private, medically underwritten PPOs—and verify networks before you lock in coverage.

What’s in the “Big, Beautiful Bill” conversation?

- Potential reductions or phase-downs of some ACA subsidies and stricter eligibility rules.

- More flexibility for states and carriers on Medicaid and plan design.

- Expanded room for alternative private plans (including PPO options) alongside marketplace plans.

Bottom line: If parts of this agenda move forward, many Floridians who rely on subsidies—or make just over subsidy thresholds—could see higher net costs. That’s why it’s critical to compare across paths, not just inside Healthcare.gov.

How it could affect Florida households

- Unsubsidized middle-income families: may face higher premiums and deductibles.

- Self-employed/1099 workers: may prefer PPO flexibility and national networks, especially if they travel.

- Employer coverage: adding family members can be costly—splitting coverage (employee on group; spouse/kids on ACA or PPO) can save.

ACA vs. Private PPO (2025 snapshot)

ACA Marketplace

- Deductibles: often $9,000–$18,000

- Networks: HMO/EPO-heavy; state-limited

- Premiums: depend on income-based subsidies

- Pre-existing: always covered

- Good fit: strong subsidy eligibility; in-network providers available

Private PPO (Underwritten)

- $0-deductible options in many cases

- Nationwide PPO access; out-of-network benefits common

- Premiums: often lower for healthy applicants

- Pre-existing: case-by-case underwriting

- Good fit: unsubsidized families, frequent travelers, provider-specific needs

COBRA & health-share notes

- COBRA: keeps your old plan but you pay the full freight + fees; can be a short-term bridge.

- Health-share ministries: not insurance; limited protections and exclusions.

Your decision path (simple)

- Send providers & prescriptions. We verify ACA and PPO networks/tiers first.

- Compare total annual cost (premium + likely usage + max out-of-pocket).

- Choose and enroll with clean effective dates—avoid gaps.

Quick FAQs

Is a private PPO always cheaper?

Can you time my start date?

Can I split my family?

For education only; eligibility, benefits and rules vary by carrier and state. Always review official plan documents and current federal/state guidance.

Affordable Health Insurance in Florida for the Self-Employed – 2025 Guide

Florida • Self-Employed Guide

Florida Self-Employed Health Insurance (2025): Your Practical Guide

Fast take: If you’re self-employed in Florida, you can choose between ACA Marketplace plans (with potential subsidies) and private medically underwritten PPOs if eligible—plus HSA strategies that may lower taxes. The right fit depends on income, doctors, travel needs, and how you prefer to pay (premium vs. out-of-pocket).

Your main paths in 2025

1) ACA Marketplace (Obamacare)

- Why it wins: Guaranteed issue, potential premium tax credits and cost-sharing reductions based on your 2025 MAGI.

- Consider: Networks can be narrower; compare your doctors and Rx tiers before enrolling.

- Best for: Variable income or households likely to qualify for subsidies.

2) Private Medically Underwritten PPO

- Why it wins: Broad PPO access and potentially lower premiums vs. unsubsidized ACA plans for healthy applicants.

- Consider: Approval is selective; eligibility depends on your health profile. We pre-screen quickly.

- Best for: Frequent travelers, provider-sensitive households, and those who pass underwriting.

3) HSA-friendly plan strategy

- Why it wins: Contributions may reduce taxable income; funds roll over year to year.

- Consider: You’ll want a cushion for routine care; HSAs work best if you can save steadily.

- Best for: Self-employed with predictable or lower annual usage who value tax efficiency.

How to choose (simple framework)

- Income: If you likely qualify for subsidies → price the ACA first.

- Doctors/hospitals: If specific providers matter → confirm networks (ACA vs. PPO) before anything else.

- Travel: If you work around Florida/US → PPO flexibility can reduce out-of-network surprises.

- Cash flow: Prefer predictable premiums? Consider richer plans or PPOs; comfortable with variability? HSA paths can win.

Quick FAQs (Florida • Self-Employed • 2025)

How do I estimate my 2025 income for subsidies?

Can I switch from ACA to a private PPO mid-year?

Do HSAs work if I’m self-employed?

Will you verify my providers?

For education only; benefits and eligibility vary by carrier and state. Always review official plan documents.

Year-Round Health Insurance Options – How to Get Covered Outside of Open Enrollment

“Can you get health insurance outside of Open Enrollment? Yes. From Special Enrollment Periods after life events to private medically underwritten PPOs with nationwide networks, there are year-round options to lock in coverage and control costs. Learn what qualifies and how RKA can help.”

Enrollment Guides • Year-Round Options

Year-Round Health Insurance Options Outside Open Enrollment

Fast take: Missed Open Enrollment? You still have paths. Qualify for a Special Enrollment Period (life event or some income situations), or—if eligible—apply for a private, medically underwritten PPO that can start any month. We’ll verify doctors, prescriptions, and start dates to avoid gaps.

Path #1: Special Enrollment Period (SEP)

If you’ve had a Qualifying Life Event, you can enroll in ACA Marketplace coverage outside the normal window. Common QLEs:

- Loss of coverage: losing employer coverage, aging off a parent’s plan, COBRA ending.

- Household changes: marriage, divorce, birth/adoption, death.

- Residence changes: moving to a new ZIP/state with different plan options.

- Income changes: shifts that affect subsidy eligibility (varies by state and year).

Timing: Most SEPs last 60 days from the event. We’ll help confirm your documentation and the correct effective date.

Path #2: Income-based options (some situations)

In certain circumstances, income within specific ranges can create ongoing or monthly SEP eligibility. If your income is variable, we’ll model your estimated MAGI and confirm your current-year eligibility.

Path #3: Private, medically underwritten PPO (if eligible)

- Year-round starts: Many private PPOs offer effective dates any month after underwriting.

- Broader networks: Often nationwide PPO access—great for frequent travelers or multi-state households.

- Underwriting: Health questions apply; we pre-screen quickly and verify your doctors/hospitals.

Avoid gaps: simple checklist

- List your providers (names, locations) and prescriptions.

- Note your QLE date and keep documents handy.

- Share your target start date so we align deadlines and carrier cutoffs.

- We’ll show total annual cost (premium + likely usage) for each option.

Quick FAQs

How fast can coverage start?

What if I don’t have a QLE?

Can you confirm my doctors?

For education only; eligibility, plan availability, and dates vary by state and carrier. Always review official Marketplace and plan documents.

Affordable Health Insurance in Florida for the Self-Employed – 2025-2026 Guide

Guide • Open Enrollment

Open Enrollment Health Insurance Deadlines: What to Know & When to Enroll

Fast take: Open Enrollment is the main window to choose coverage for the upcoming year. If you miss it, you’ll need a Special Enrollment Period (life event or qualifying income) or you can explore eligible private PPO options if you qualify.

Key windows at a glance

Open Enrollment (most states)

- Occurs in late fall through mid-January for coverage beginning Jan 1 (or Feb 1 for later selections).

- Best time to compare ACA plans and confirm doctors/Rx.

- We’ll confirm this year’s exact dates for your state.

Special Enrollment (life events)

- Qualifying Life Events (QLEs): loss of coverage, marriage/divorce, birth/adoption, move, etc.

- Typically a 60-day window (varies by event/state).

- We help document and enroll before the deadline.

Income-based SEP (some situations)

- Certain income ranges may unlock a monthly SEP in some states.

- Helpful if income fluctuates or you missed OEP.

- We’ll check eligibility and project your MAGI.

Private PPO (if eligible)

- Some medically underwritten options enroll year-round.

- We pre-screen underwriting and confirm nationwide access.

- Useful for travelers or doctor-specific households.

How to avoid missing your window

- Set reminders: Book a consult ahead of OEP so we can verify doctors and run cost projections.

- Gather details: Provider list (names & locations), prescriptions, and estimated income (MAGI).

- Pick confidently: We’ll show total annual cost (premium + likely usage) and confirm effective dates.

Quick FAQs

Do state-based Marketplace dates differ?

Can I switch plans mid-year?

Are private PPOs available in my state?

For education only; eligibility, plan availability, and dates vary by state and carrier. Always review official Marketplace notices and plan documents.

Open Enrollment 2026: Why Working with a Licensed Advisor is Essential

Open Enrollment 2025 is here. Don’t go it alone—licensed advisors know ACA vs. private PPO options, deadlines, and ways to save. Acting early avoids rate hikes and limited plan choices.

Enrollment Guides • Open Enrollment 2025

Open Enrollment 2025: The Hidden Costs of Doing It Alone

Fast take: Open Enrollment is your only chance each year to secure or update coverage—but going solo can cost you. Licensed advisors know deadlines, subsidies, and private PPO alternatives to help you avoid higher premiums and missed benefits.

Why working with an advisor matters

A licensed advisor not only has access to all available plans—including ACA Marketplace and private options—but also the expertise to evaluate your needs and recommend coverage tailored to your situation. Many unlicensed brokers push limited-benefit plans that don’t protect you when it matters most.

Key benefits of guidance

- Accurate info on what your plan covers.

- Verification of which doctors are in-network.

- Projection of maximum out-of-pocket costs.

- Strategies to maximize savings based on income & health.

How a licensed advisor may save you money

Private PPOs can reward good health with lower premiums—similar to car insurance rewarding safe drivers. ACA Marketplace plans offer income-based savings. By reviewing both, advisors help you avoid costly mistakes and secure the best value.

Quick steps to start enrollment with confidence

Open Enrollment runs November 1 – January 15, but acting early locks in better options:

- Nov 1: Open Enrollment begins.

Preparing for Open Enrollment 2026: Key Steps Every Consumer Should Know

Open Enrollment 2026 runs Nov 1, 2025 – Jan 15, 2026. Learn key deadlines, cost trends, and smart moves to compare ACA Marketplace vs. private PPO options. Get guidance from RKA Insurance Advisors to lock the right coverage before prices ju

Preparing for Open Enrollment 2026: Dates, Deadlines, and Smart Moves

Fast take: For most states, Open Enrollment runs Nov 1, 2025 – Jan 15, 2026. Enroll by Dec 15 for a Jan 1 start; enroll by Jan 15 for a Feb 1 start. We compare Marketplace (government) vs. Private PPO (licensed access) side-by-side, verify doctors & prescriptions, and lock 2026 costs—no pressure, just answers.

Need help choosing the best fit in your ZIP?

We’ll verify your doctors and medications, compare Marketplace vs. Private PPO, and show clear costs—no pressure, just answers.

Why costs are climbing

- Medical inflation: Hospital, physician, and facility prices continue to outpace wage growth.

- Rx trend: Specialty drugs (including GLP-1 therapies) are widening spend.

- Higher utilization: Delayed care is catching up, pushing claims higher.

- Plan design shifts: Employers may raise deductibles/copays or adjust contributions.

What to compare during open enrollment (October–December)

Marketplace (Government)

- Premium tax credits available if income qualifies.

- HMO/EPO networks are common; referrals often required.

- County-based networks; choices vary by ZIP.

- Available during Open Enrollment or a qualifying life event.

Private PPO (Licensed Access)

- Broad PPO access; referrals typically not required.

- Medically underwritten—can be lower-cost for healthy households.

- Often better for travel, provider choice, or specialist access.

- Available year-round (subject to eligibility and effective-date rules).

Key 2026 enrollment timing

- Enroll by Dec 15, 2025 for coverage starting Jan 1, 2026.

- Enroll by Jan 15, 2026 for coverage starting Feb 1, 2026.

- State-based exchanges may vary—ask us to confirm your state’s exact dates.

How RKA helps (no pressure—just answers)

- Side-by-side comparisons: Marketplace vs. Private PPO, matched to your doctors and prescriptions.

- Network & Rx checks: We confirm providers and tiers up front to prevent surprises.

- Year-round support: We stay with you for renewals, plan changes, and claims questions.

Want a side-by-side Marketplace vs. Private PPO analysis?

We’ll verify networks and medications, compare plans in your ZIP, and show clear costs—no pressure, just answers.

Quick FAQs

Is the employer plan always best?

Not always. If spousal or child premiums are high, placing them on Marketplace or Private PPO can cut total household cost while keeping access. We’ll model both paths.

Can you verify our doctors and hospitals first?

Yes. We confirm providers and prescriptions up front so you avoid out-of-network surprises or Rx tier shocks later.

Can we switch mid-year?

Generally only with a qualifying life event. Otherwise, Open Enrollment is your main window. Private PPOs may offer licensed access year-round if eligible.

Educational use only; benefits and eligibility vary by employer, carrier, and state. Always review official plan documents.

Understanding Insurance Networks: A Key Component of Your Health Coverage

HMO, PPO, EPO, POS—your plan’s network determines which doctors you can see and what you’ll pay. Learn the key differences, when referrals apply, how out-of-network care works, and which network type best fits your doctors, prescriptions, and travel needs.

Guide • Networks & Access

Understanding Health Insurance Networks: HMO vs PPO vs EPO vs POS

Fast take: Your network determines where you can get care and what you’ll pay. If you have must-keep doctors, travel frequently, or want nationwide access, choose your network type first—then compare deductibles and copays.

The four common network types

HMO — “Stay in the circle”

- Primary Care Physician (PCP) and referrals usually required.

- No out-of-network coverage (except emergencies).

- Often lower premiums; tight local networks.

PPO — “More flexibility”

- No referrals needed to see specialists.

- Out-of-network benefits (higher costs); national networks vary.

- Good for travelers or multi-state families.

EPO — “HMO-like, no referrals”

- Referrals typically not required.

- Little to no out-of-network coverage beyond emergencies.

- Popular on ACA Marketplace; check local access.

POS — “Hybrid”

- PCP + referrals for in-network care.

- Some out-of-network benefits at higher cost.

- Useful when you want a PCP gatekeeper with flexibility.

Key rules to check before you enroll

- Provider verification: Search by doctor name + NPI and confirm at the practice level.

- Facility alignment: A doctor can be in network while their preferred hospital is not—verify both.

- Prior authorization: Imaging, infusions, surgeries, and some meds may need pre-approval.

- Rx formulary & tiers: Confirm your drugs, quantity limits, and preferred pharmacies.

- Out-of-area care: If you travel or have college students away from home, read the away-from-home rules.

Which network should I choose?

- Keep local doctors, low cost: HMO/EPO may work—verify providers and prior-auth rules.

- Travel frequently / multi-state family: PPO or a plan with nationwide access is usually safer.

- Want a coordinating PCP but some flexibility: POS can balance referrals with out-of-network options.

Quick FAQs

Are urgent care visits covered out of network?

My doctor says they “take” my plan—am I safe?

Can I change networks mid-year?

For education only; benefits and eligibility vary by carrier and state. Always review official plan documents.

How Biden’s 2025 Short-Term Insurance Rule Changes Affect You

Biden’s new short-term insurance rule cuts plans to 3 months with only a 1-month renewal. Self-employed workers and contractors may be at risk—see ACA, PPO, and employer coverage alternatives with RKA.

Health Insurance Updates • Policy Change

What Changed in Biden’s Short-Term Insurance Rule?

Fast take: Starting in September 2025, new federal rules limit short-term medical plans to 3 months, with just a 1-month renewal. This change reduces flexibility and leaves many—especially self-employed workers—needing new solutions.

Why the new rules put many at risk

Providers like Golden Rule, National General, Everest, and Pivot Health have offered short-term plans as flexible, stopgap coverage. Under the new rule, these plans are much less viable. Many households will need to reassess coverage options before losing protection.

Your alternatives: Marketplace vs. underwritten plans

ACA Marketplace Plans

These plans guarantee acceptance regardless of pre-existing conditions. Subsidies may reduce premiums, but networks and deductibles can vary widely.

Medically Underwritten Plans

For healthy individuals, private PPOs may provide lower monthly costs and nationwide access. Underwriting applies, but these plans often mean lower out-of-pocket exposure compared to unsubsidized ACA coverage.

Employer Coverage

If you’re eligible through an employer, group plans remain strong options. However, adding dependents can drive up costs—so review carefully.

Secure your coverage today

The new rules significantly reduce the flexibility of short-term plans. Acting now ensures you avoid gaps in coverage and rising costs. At RKA Insurance Advisors, we specialize in navigating these changes and finding the right coverage in 32 states.

Quick FAQs

When does the new rule take effect?

Can short-term plans still be useful?

How can RKA help?

For education only; eligibility, availability, and pricing vary by carrier and state. Always review official plan documents.

Understanding Health Insurance Networks: PPO vs. HMO for Small Businesses

PPO vs. HMO for small businesses: referrals, out-of-network rules, costs, and network fit. Learn how a licensed advisor can design the right coverage for your employees and budget.

Small Business • Networks & Access

Understanding Health Insurance Networks: PPO vs. HMO for Small Businesses

Fast take: Picking the right network type can save your company money and headaches. PPOs emphasize flexibility and out-of-network benefits; HMOs emphasize lower premiums and coordinated in-network care. We’ll help you match the network to your people, locations, and providers.

What is an insurance network—and why it matters

Networks determine where employees can get care and what they’ll pay. Choosing between a PPO (Preferred Provider Organization) and an HMO (Health Maintenance Organization) affects specialist access, referrals, travel coverage, and out-of-network costs.

PPO — flexibility & broader access

- No referrals required to see specialists.

- Out-of-network coverage available (higher cost-share).

- Often better for multi-state or traveling teams.

- The insurer typically does not dictate treatment via gatekeeping.

HMO — tight networks & coordinated care

- Primary Care Physician (PCP) required; referrals common.

- Generally no out-of-network coverage (emergencies excepted).

- Often lower premiums with strong in-network coordination.

- The plan may have more say in course of care via approvals.

PPO vs. HMO: cost, flexibility, and coverage

- Costs: HMOs can look cheaper monthly, but PPOs may avoid expensive out-of-network surprises for certain providers or travel patterns.

- Access: PPOs allow direct specialist access; HMOs typically require PCP referrals.

- Network fit: Always verify doctors + facilities; a doctor may be in network while their hospital is not.

Why a licensed advisor makes a difference

- Expert guidance: Understand fine print on referrals, prior auth, and tiered networks.

- Customized designs: Plan mixes (HMO + PPO), contribution strategies, HSA compatibility.

- Compliance assurance: Avoid penalties and stay aligned with regulations.

- Real savings: Prevent gaps and capture cost-savings your team will actually feel.

Risks of going it alone

- Incomplete coverage: Overlooking network or facility alignment can create costly surprises.

- Compliance issues: Missteps can trigger penalties or employee complaints.

- Missed savings: Without modeling total annual cost, you can overpay for the wrong network.

Quick FAQs

Is a PPO always the safer choice?

Do HMOs ever cover out-of-network care?

How do we verify our doctors?

For education only; benefits and eligibility vary by carrier and state. Always review official plan documents.

Avoid Tax Penalties: Navigating Health-Insurance Income Reporting (2025–2026) | RKA

Taking ACA premium credits? Keep your income estimate current and reconcile correctly to avoid surprise tax bills. Here’s how MAGI works, when to update, and how RKA helps.

Guides • Taxes & Reporting

Avoid Tax Penalties: Navigating Health-Insurance Income Reporting

Fast take: If you get ACA premium tax credits, your final subsidy is based on your actual year-end income (MAGI). To avoid surprise tax bills, keep estimates current, report life changes quickly, and reconcile correctly at tax time.

MAGI 101: What actually counts

- Start with AGI (from your 1040), then adjust for items like tax-exempt interest and nontaxable Social Security.

- Household MAGI includes the income of everyone on the return who must file taxes, not just the policyholder.

- Self-employed? Use net profit (after allowable business expenses), and revisit as the year unfolds.

Update income at the right times

- After big changes: new contract, raise/bonus, switching jobs, adding/removing a dependent, or moving.

- Quarterly check-ins: especially for variable/1099 income—prevents large year-end paybacks.

- Document it: keep notes on when/why you updated; it helps at tax time.

A simple, low-stress workflow

- Estimate annual MAGI (with a conservative range).

- Choose a plan; take only the advance credit you’re comfortable with.

- Track YTD income and adjust through your Marketplace account when needed.

- At tax time, reconcile with Form 1095-A and Form 8962.

Self-employed tips

- Buffer fund: set aside part of any premium savings for potential reconciliation.

- HSA strategy: if you’re in an HSA-eligible plan, contributions may lower MAGI.

- Quarterly rhythm: align income updates with your estimated tax payments.

Quick FAQs

What if I overestimated income?

Do I need to report small fluctuations?

Can you update my application for me?

This article is educational and not tax advice. Eligibility and benefits vary by carrier and state. Consult your tax professional about your specific situation.