Group Employer Open Enrollment: Rising Costs, Smarter Options for Employers & Employees | RKA

Employer plan premiums are rising this fall. During open enrollment, compare group coverage against marketplace and private PPO options—splitting family members can cut costs. We’ll verify doctors, prescriptions, and total annual cost before you commit.

Employer & Group Plans • Open Enrollment

Group Open Enrollment: Rising Costs, Smarter Options for Employers & Employees

Fast take: With medical inflation and rising utilization, many employer plans are increasing premiums and tweaking benefits this fall. Use open enrollment to compare — keeping the employee on the group plan, but placing a spouse/kids elsewhere can cut costs without giving up access. We’ll verify networks, prescriptions, and total annual cost before you choose.

Why costs are climbing

- Medical inflation: Hospital, physician, and facility prices continue to outpace wage growth.

- Rx trend: Specialty drugs (including GLP-1 therapies) are widening plan spend.

- Higher utilization: Delayed care is catching up, pushing claims higher.

- Plan design shifts: Employers may raise deductibles/copays or adjust contributions to manage increases.

What to compare during open enrollment (October–December)

Employer plan checklist

- Employee vs. family premium contributions

- Deductible, copays/coinsurance, out-of-pocket max

- HSA/HRA funding and employer credits

- Network type (HMO/EPO vs PPO) and doctor/hospital fit

- Rx formulary & prior authorization rules

Compare against alternatives

- Marketplace: Check income-based subsidies; silver cost-sharing reductions if eligible

- Private PPO (underwritten): Often lower for healthy applicants; nationwide PPO access

- Spouse’s employer plan: Sometimes better dependent rates

- COBRA: Short-term bridge if switching mid-year

When keeping the group plan and splitting the family wins

Dependent premiums on employer plans can be steep. A common savings move: keep the employee on the group plan (to capture employer contribution and HSA access) and place a spouse or kids on marketplace or a private PPO if the numbers — and networks — work better.

Decision pathway

- Send us your details: household members, providers, prescriptions, and employer plan options.

- We verify networks & Rx: employer plan vs marketplace vs private PPO.

- We model total annual cost: premium + likely usage + tax/HSA effects.

- You pick and enroll: we execute cleanly and avoid gaps.

Tips for employers (quick wins)

- Offer an HSA-compatible plan with modest employer HSA seed to offset deductibles.

- Communicate a clear “how to compare plans” guide with provider verification steps.

- Consider ICHRA/QSEHRA strategies if group renewal is unsustainable.

Quick FAQs

Is the employer plan always best?

Can you verify our doctors and hospitals first?

Can we switch mid-year?

Educational use only; benefits and eligibility vary by employer, carrier, and state. Always review official plan documents.

COBRA vs Marketplace vs Private PPO: What to Do Right After You Lose Employer Coverage

Quick guide to COBRA vs Marketplace vs Private PPO—costs, networks, and when each wins. We’ll verify your doctors and show clear prices.

COBRA vs Marketplace vs Private PPO: What to Do Right After You Lose Employer Coverage

Laid off, new job, or between jobs? Here’s the fast, practical guide—costs, networks, deadlines, and how to decide in minutes. We’ll verify your doctors and show clear costs.

- Same network/benefits you already know.

- Usually most expensive (you pay full premium + 2%).

- Time-limited (18 months); retroactive if elected on time.

- Good when in treatment and changing plans is risky.

- May be cheapest if your income qualifies for credits.

- Many plans are HMO/EPO; referrals are common.

- Mid-year move allowed due to loss of coverage.

- Credits reconcile at tax time—under-reporting income can create payback.

- Nationwide PPO when eligible; keep specialists/hospitals.

- Typically no referrals; fewer hoops.

- Advance premium tax credits do not apply to Private PPOs.

- Pricing = age, ZIP, benefits, and network.

- Great when you travel or want doctor choice.

What tends to cost more—and why

Why COBRA is often pricey

- You pay the entire employer premium + 2% admin fee.

- Large-group plan designs can carry higher OOP maxes.

- No income-based help.

How non-Marketplace Private PPO prices

- Based on age, ZIP, network size, and benefits.

- Good fits: provider choice, travel, specialist access, fewer referrals.

- We verify your doctors before you switch.

How to decide in minutes

Pick COBRA if…

- You’re mid-treatment and can’t risk network changes.

- You can stomach short-term higher premiums.

- You need exactly the same plan and doctors right now.

Pick Private PPO if…

- You want nationwide PPO and typically no referrals.

- You travel, use specialists, or dislike gatekeepers.

- Credits don’t help you—or you prefer not to use them.

Want the best post-employer fit in your ZIP?

We’ll verify your doctors and meds, compare COBRA vs Marketplace vs Private PPO, and show clear costs. No pressure—just answers.

FAQ

How long do I have to elect COBRA?

Can I switch from COBRA to other coverage later?

Do Private PPOs use ACA tax credits?

How do I know if my doctors are covered?

How do we start?

This overview is educational, not tax or legal advice. Availability varies by state and carrier. Eligibility and enrollment subject to plan terms.

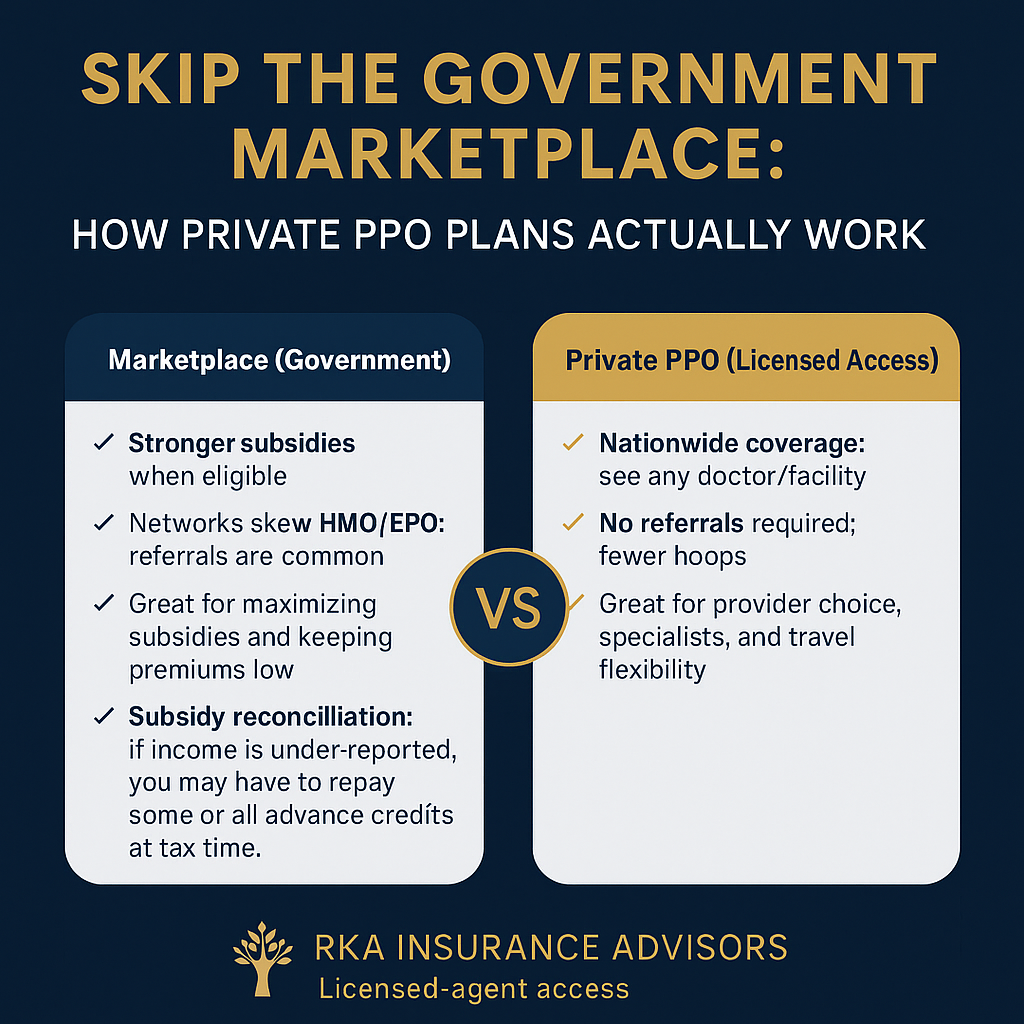

Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

Why some people skip the Marketplace

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

How Private PPO actually works

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

Do Private PPOs need referrals?

Will I owe taxes if I’m not using subsidies?

How do I know if my doctor is covered?

How do we start?

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.

Marketplace vs Private PPO: Costs, Networks, and When Each Wins

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs

Coverage Options • Open Enrollment

Marketplace vs. Private PPO: Costs, Networks, and When Each Wins

Fast take: Marketplace (government exchange) plans can be cheapest if your income qualifies for subsidies. Private PPOs usually win on doctor access, nationwide networks, and fewer hoops. At RKA Insurance Advisors, we compare both—then you decide.

Quick Definitions

- Marketplace (Government): Plans sold on Healthcare.gov or your state exchange. Prices drop with income-based subsidies. Networks are often HMO/EPO-heavy.

- Private PPO (licensed access): Off-exchange, available through licensed advisors. Broader PPO networks, out-of-network flexibility, and year-round enrollment.

👉 No guessing: We verify your doctors and prescriptions on both sides before you enroll.

Cost Snapshot

Marketplace

Price depends on income and household size. Silver-tier plans can unlock extra savings if you qualify.

Private PPO

Price is not income-based. You’re paying for broader networks and fewer restrictions.

Networks & Doctors (What Matters Most)

Marketplace networks can be narrow. Great if your providers are in-network; painful if they’re not. Private PPOs typically offer national or near-national PPO networks, plus out-of-network benefits.

We always check your providers first—not after you enroll.

When Marketplace Wins

- Your income qualifies for strong subsidies.

- You’re fine with a narrower network.

- You want the lowest possible premium and rarely use care.

When Private PPO Wins

- You want flexibility with doctors and facilities.

- You travel often and need PPO access nationwide.

- You’ve been frustrated with referrals and authorizations before.

The Simple Decision Tree

- Share your providers, prescriptions, and budget.

- We verify both Marketplace and PPO paths in your ZIP code.

- You pick the best fit. We enroll you quickly and compliantly.

Quick FAQs

Does Marketplace always cost less?

Can RKA check my doctors in both networks?

Is Private PPO available year-round?

Educational use only; eligibility and benefits vary by state and carrier. Always review official plan documents.

Year-Round Health Insurance Options – How to Get Covered Outside of Open Enrollment

“Can you get health insurance outside of Open Enrollment? Yes. From Special Enrollment Periods after life events to private medically underwritten PPOs with nationwide networks, there are year-round options to lock in coverage and control costs. Learn what qualifies and how RKA can help.”

Enrollment Guides • Year-Round Options

Year-Round Health Insurance Options Outside Open Enrollment

Fast take: Missed Open Enrollment? You still have paths. Qualify for a Special Enrollment Period (life event or some income situations), or—if eligible—apply for a private, medically underwritten PPO that can start any month. We’ll verify doctors, prescriptions, and start dates to avoid gaps.

Path #1: Special Enrollment Period (SEP)

If you’ve had a Qualifying Life Event, you can enroll in ACA Marketplace coverage outside the normal window. Common QLEs:

- Loss of coverage: losing employer coverage, aging off a parent’s plan, COBRA ending.

- Household changes: marriage, divorce, birth/adoption, death.

- Residence changes: moving to a new ZIP/state with different plan options.

- Income changes: shifts that affect subsidy eligibility (varies by state and year).

Timing: Most SEPs last 60 days from the event. We’ll help confirm your documentation and the correct effective date.

Path #2: Income-based options (some situations)

In certain circumstances, income within specific ranges can create ongoing or monthly SEP eligibility. If your income is variable, we’ll model your estimated MAGI and confirm your current-year eligibility.

Path #3: Private, medically underwritten PPO (if eligible)

- Year-round starts: Many private PPOs offer effective dates any month after underwriting.

- Broader networks: Often nationwide PPO access—great for frequent travelers or multi-state households.

- Underwriting: Health questions apply; we pre-screen quickly and verify your doctors/hospitals.

Avoid gaps: simple checklist

- List your providers (names, locations) and prescriptions.

- Note your QLE date and keep documents handy.

- Share your target start date so we align deadlines and carrier cutoffs.

- We’ll show total annual cost (premium + likely usage) for each option.

Quick FAQs

How fast can coverage start?

What if I don’t have a QLE?

Can you confirm my doctors?

For education only; eligibility, plan availability, and dates vary by state and carrier. Always review official Marketplace and plan documents.

Open Enrollment 2026: Why Working with a Licensed Advisor is Essential

Open Enrollment 2025 is here. Don’t go it alone—licensed advisors know ACA vs. private PPO options, deadlines, and ways to save. Acting early avoids rate hikes and limited plan choices.

Enrollment Guides • Open Enrollment 2025

Open Enrollment 2025: The Hidden Costs of Doing It Alone

Fast take: Open Enrollment is your only chance each year to secure or update coverage—but going solo can cost you. Licensed advisors know deadlines, subsidies, and private PPO alternatives to help you avoid higher premiums and missed benefits.

Why working with an advisor matters

A licensed advisor not only has access to all available plans—including ACA Marketplace and private options—but also the expertise to evaluate your needs and recommend coverage tailored to your situation. Many unlicensed brokers push limited-benefit plans that don’t protect you when it matters most.

Key benefits of guidance

- Accurate info on what your plan covers.

- Verification of which doctors are in-network.

- Projection of maximum out-of-pocket costs.

- Strategies to maximize savings based on income & health.

How a licensed advisor may save you money

Private PPOs can reward good health with lower premiums—similar to car insurance rewarding safe drivers. ACA Marketplace plans offer income-based savings. By reviewing both, advisors help you avoid costly mistakes and secure the best value.

Quick steps to start enrollment with confidence

Open Enrollment runs November 1 – January 15, but acting early locks in better options:

- Nov 1: Open Enrollment begins.

How Biden’s 2025 Short-Term Insurance Rule Changes Affect You

Biden’s new short-term insurance rule cuts plans to 3 months with only a 1-month renewal. Self-employed workers and contractors may be at risk—see ACA, PPO, and employer coverage alternatives with RKA.

Health Insurance Updates • Policy Change

What Changed in Biden’s Short-Term Insurance Rule?

Fast take: Starting in September 2025, new federal rules limit short-term medical plans to 3 months, with just a 1-month renewal. This change reduces flexibility and leaves many—especially self-employed workers—needing new solutions.

Why the new rules put many at risk

Providers like Golden Rule, National General, Everest, and Pivot Health have offered short-term plans as flexible, stopgap coverage. Under the new rule, these plans are much less viable. Many households will need to reassess coverage options before losing protection.

Your alternatives: Marketplace vs. underwritten plans

ACA Marketplace Plans

These plans guarantee acceptance regardless of pre-existing conditions. Subsidies may reduce premiums, but networks and deductibles can vary widely.

Medically Underwritten Plans

For healthy individuals, private PPOs may provide lower monthly costs and nationwide access. Underwriting applies, but these plans often mean lower out-of-pocket exposure compared to unsubsidized ACA coverage.

Employer Coverage

If you’re eligible through an employer, group plans remain strong options. However, adding dependents can drive up costs—so review carefully.

Secure your coverage today

The new rules significantly reduce the flexibility of short-term plans. Acting now ensures you avoid gaps in coverage and rising costs. At RKA Insurance Advisors, we specialize in navigating these changes and finding the right coverage in 32 states.

Quick FAQs

When does the new rule take effect?

Can short-term plans still be useful?

How can RKA help?

For education only; eligibility, availability, and pricing vary by carrier and state. Always review official plan documents.

Lost Health Insurance?

Lost health insurance? Most people qualify for a Special Enrollment Period. Compare ACA vs. private PPO options, verify your doctors, and start coverage quickly with RKA

Enrollment Guides • Special Enrollment

Lost Health Insurance? What to Do Next

Fast take: Losing coverage is stressful—but you have options. Most people qualify for a Special Enrollment Period (SEP) to enroll in a new plan. We’ll help you compare ACA vs. private PPO options, verify your doctors, and start coverage quickly.

Step 1: Assess your situation

Confirm why and when your coverage ends (job change, hours reduction, divorce, aging off a parent’s plan, etc.). Your reason sets your eligibility window and documentation needs.

Step 2: Talk to a licensed advisor

Health insurance has moving parts—networks, Rx tiers, referrals, and deadlines. A licensed advisor helps you avoid gaps and costly mistakes while matching plans to your providers and budget.

Step 3: Check eligibility for a Special Enrollment Period (SEP)

- Common QLEs: loss of employer coverage, COBRA ending, move to a new ZIP/state, marriage/divorce, birth/adoption, income changes.

- Timing: Most SEPs last 60 days from the event. We’ll confirm your exact window and effective date rules.

ACA Marketplace Plans

- Guaranteed acceptance.

- Potential income-based subsidies to lower premiums.

- Networks and deductibles vary—verify your doctors and Rx.

Private Medically Underwritten PPOs

- Often lower premiums for healthy applicants.

- Frequent nationwide PPO access—good for travelers.

- Underwriting applies; we pre-screen and confirm networks first.

Step 4: Consider COBRA vs. switching

COBRA keeps your employer plan temporarily but you pay the full premium (plus admin fee). We’ll run ACA vs. PPO vs. COBRA side-by-side so you can see total annual cost with your expected usage.

Step 5: Budget for healthcare costs

- Monthly premium and employer/COBRA contribution (if any).

- Deductible, copays, coinsurance, and maximum out-of-pocket.

- Prescription costs and prior authorization requirements.

Step 6: Secure new coverage—without gaps

Once we’ve confirmed eligibility and networks, we’ll submit your application, confirm your effective date, and set up online account access and ID cards.

Quick FAQs

Will I have a gap between plans?

Can I switch off COBRA later?

Can you verify my doctors before I enroll?

For education only; eligibility, plan availability, and dates vary by state and carrier. Always review official plan documents.